Comfort opens historic homes for annual tour

For docent Laura Lee Hines, working the 2023 Comfort Tour of Homes was a trip back in time.

“The home is owned by the Parrish family, who bought it in 1973. They did the restoration on it. I think they saved its life, probably,” Hines said, standing in the doorway of the Otto Brinkmann House -- one of six revamped, refurbished and renovated 100-year-old-plus homes on the Comfort Heritage Foundation’s “Tour of Homes With History” held Oct. 21.

Attendees walked up and down High Street, stopping in and getting brief tours of the six spotlighted homes. The owners, or current residents, or Heritage Foundation docents greeted the visitors and briefed them on the homes as they entered.

The Otto Brinkmann House was built in governmental entity such as Kendall County in which their project resides” in order to proceed, he added.

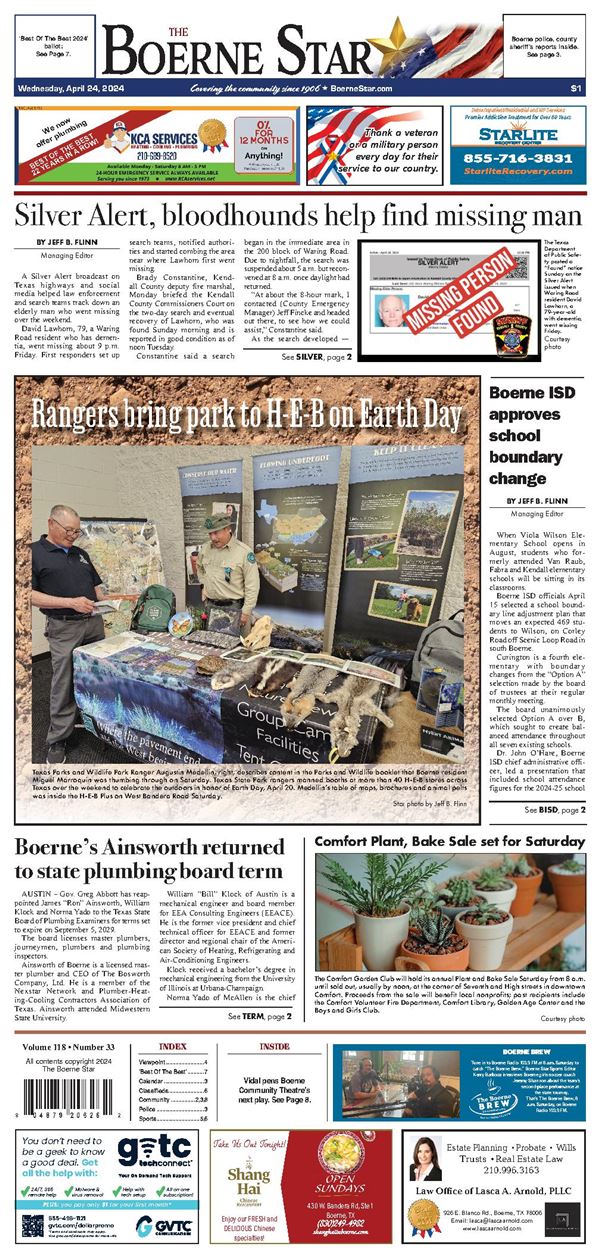

Comfort 2023 Tour of Homes participants enter the Otto Brinkmann House, built in 1860 and still lived in today. Docent Laura Lee Hines, who greeted them inside, lived in the home for several years. Star photo by Jeff B. Flinn

“This is an expansion of our campus on what is a vacant eight acres, adding 80 additional independent living residences,” Crump said. “If everything moves forward as scheduled, I would begin construction in the next couple of months.” But commissioners began to question Morningside’s tax-exempt request. Precinct 3 Commissioner Richard Chapman cited the county’s duties to the Morningside expansion, if it were approved.

“When I look at the tax rolls, it shows $65 million of improvements, of which the tax consequence to the people here is zero,” Chapman said. “But yet we provide fire service, we provide EMS service, we provide law enforcement service and yet it’s a tax-exempt organization.”

Precinct 4 Commissioner Chad Carpenter questioned the fairness of competition between taxed and nontaxed organizations.

“We have several developments in our county (who) are competing with other people for the same business and are not paying taxes like the rest of the companies,” Carpenter said.

Carpenter referred to property purchased by Christus Santa Rosa “that is tied up, its off the tax roll ... whereas someone in the private sector, if they would have owned that property, Kendall County residents would have had the benefit of tax money coming in, just like any other business.”

'I don’t like it,” Carpenter said. “Everyone should be paying their part. We have apartments in Boerne that are non-taxed. We have a lot of this going on, and I am tired of it.”

When asked what impact a “no” vote would have for Morningside, Crump said, “We would certainly have to reconsider and go back to the drawing board with our projects.”

Precinct 2 Commissioner Andra Wisian mentioned her time spent serving with a nonprofit organization.

“It’s not anybody's fault, this is just an odd loophole for a nonprofit,” Wisian said. “I was part of a nonprofit for many, many years and never received one penny; in fact, (I) donated a lot of money.”

She addressed Crump and said, “Your base compensation was $328,245, according to your (IRS tax form) 990 from 2021. Your executive director’s (salary) is $154,367. To me, this doesn’t sound like a nonprofit, so I am not in favor of this.”

A motion was made and County Judge Shane Stolarczyk joined all four commissioners in denying the motion to allow tax-exempt financing.

Comment

Comments